How Biodegradable Packaging Is Winning the Global Fast-Food Race

Introduction

The global fast-food industry, valued at over $900 billion in 2024, is at a tipping point. Environmental concerns, regulatory mandates, and consumer activism have shifted the industry’s focus from mere convenience to sustainable impact. The race to phase out traditional plastics is no longer optional; it’s an imperative.Biodegradable packaging has emerged as the most disruptive force, fundamentally reshaping supply chains, branding, and global competition.

This article explores how biodegradable packaging is revolutionizing the fast-food sector, benchmarking material choices, company strategies, regional trends, and the pivotal role of innovative leaders – read on to find more info!

I. Global Fast-Food Giants’ Green Packaging Roadmap

1. Industry Landscape & Drivers

Major fast-food corporations face mounting pressure from governments and consumers alike. Plastic bans and “green” certifications are now standard, not differentiators. A 2023 Statista survey showed 61% of global consumers prefer brands with visible eco-friendly packaging efforts. According to the Ellen MacArthur Foundation’s circular economy in packaging initiative, over 500 brands have pledged to shift to 100% reusable, recyclable, or compostable packaging by 2030.

2. Leading Brands and Their Sustainability Milestones

|

Company |

Region |

Key Packaging Pledge |

Milestone Year |

Status 2024 |

|

McDonald’s |

Global |

100% renewable/recyclable packaging |

2025 |

82% achieved |

|

Starbucks |

Global |

100% compostable/disposable cups |

2025 |

77% achieved |

|

KFC/Yum! Brands |

Global |

No plastic straws/cutlery |

2023 |

100% achieved |

|

Burger King |

Global |

PFAS-free and recyclable wrappers |

2025 |

65% achieved |

|

Costa Coffee |

Europe/APAC |

PLA-free, compostable cups |

2026 |

Pilots ongoing |

|

Tim Hortons |

N. America |

Closed-loop recycling system |

2024 |

70% achieved |

3. The Asian Acceleration

Asia-Pacific (APAC), led by China, South Korea, and Japan, is experiencing a “leapfrog” effect in sustainable packaging. While EU regulations set the global agenda, Asian cities (e.g., Shanghai, Seoul) have mandated the use of biodegradable or compostable food packaging in all public institutions, accelerating industry transformation.

Case Note:

China’s 2022 ban on non-degradable takeout packaging in Tier 1 cities led to a 45% spike in demand for paper bowls with lids and bagasse clamshell boxes, rapidly expanding the market for regional producers and exporters.

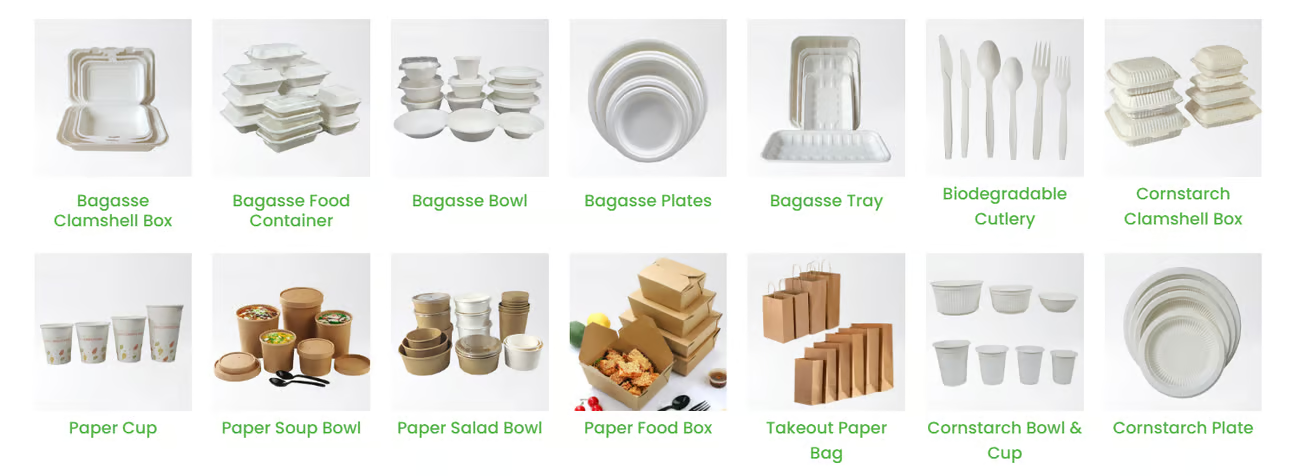

II. Biodegradable Packaging Materials Showdown

The global sustainable food packaging market has seen double-digit growth over the past five years, reflecting both consumer demand and regulatory requirements (Statista: Sustainable Packaging). Among the leading materials, bagasse and cornstarch have shown rapid adoption in North America and Asia, particularly in the QSR sector.

1. The Main Contenders: Comparative Analysis

|

Material |

Source |

Compostability |

Degradation Time |

Cost Level |

Food Safety |

Global Adoption |

|

Bagasse |

Sugarcane waste |

Yes (home/ind.) |

60–120 days |

Medium |

High |

Widespread |

|

Cornstarch |

Corn starch |

Yes (mainly ind.) |

90–180 days |

Medium |

High |

Growing |

|

PLA (Polylactic) |

Plant-based |

Industrial only |

120–180 days |

Medium-High |

High |

Common in US/EU |

|

Kraft Paper |

Wood pulp |

No (unless coated) |

N/A |

Low-Medium |

Variable |

Declining |

|

Wood/CPLA |

Wood/cellulose |

Yes (home/ind.) |

60–120 days |

High |

High |

Premium niche |

|

Edible Films |

Algae, seaweed |

Yes (edible) |

7–30 days |

Premium |

Variable |

Experimental |

2. Market Preferences and Regional Differences

- Europe: Favors fiber-based, PFAS-free solutions (bagasse, molded pulp).

- North America: PLA, cornstarch, and bagasse dominate quick-service restaurant (QSR) pilots.

- Asia: Sugarcane bagasse and cornstarch packaging, especially in China and India.

3. Key Selection Criteria for Brands

- Compostability standard (EN13432, ASTM D6400)

- Food contact safety (FDA/EU/China GB standards)

- Shelf life and resistance to heat, grease, and liquids

- End-of-life infrastructure (home composting, municipal industrial compost)

III. Supply Chain Transformation & Packaging Innovation

1. Redefining Sourcing and Operations

Switching to biodegradable packaging is not a simple material swap. It reshapes procurement, production, logistics, and even menu design. Companies now evaluate suppliers not only by price and lead time but also by certifications, carbon footprint, and alignment with sustainability goals.

Example:

Leading QSRs have started direct collaborations with biodegradable tableware manufacturers in China and Southeast Asia, investing in custom molds and closed-loop recycling partnerships.

2. Smart Manufacturing & Digital Logistics

- Digital twins for supply chain optimization.

- IoT-enabled tracking for packaging lifecycle and traceability.

- On-demand printing and laser engraving for branding on bagasse trays and paper bowls.

3. The Bioleader® Case Study

As a pioneer and leading biodegradable tableware manufacturer, Bioleader® exemplifies the new industrial standard.

Key facts:

- Annual capacity: 800 million+ compostable products shipped worldwide

- Vertical integration: In-house R&D, mold design, and end-to-end quality control

- Certifications: EN13432, OK Compost, FDA, BPI, LFGB, ISO22000

- Key partnerships: Global QSR brands, supermarket chains, and food delivery platforms

Bioleader’s approach:

- Custom solutions (e.g., tailored paper bowls with lids for both hot soups and cold salads)

- Rapid sample prototyping and short lead times

- Proactive support for client ESG reporting and compliance documentation

“Our vision goes beyond product sales. We see ourselves as a strategic partner in our clients’ sustainability journey, helping them reduce plastic waste, build brand trust, and win in the green economy.”

— Junso Zhang, Founder, Bioleader®

IV. Policy-Driven Growth & Market Opportunity

The European Union’s single-use plastics legislation is perhaps the most aggressive, banning several categories of single-use items and driving innovation across the supply chain. In the United States, local regulations are supported by collaborative industry action, such as the U.S. Plastics Pact roadmap, which aims to accelerate the transition to circular packaging solutions by 2025.

1. The Policy Landscape

|

Country/Region |

Major Regulation/Timeline |

Scope of Ban/Requirement |

|

EU |

Single-use plastics directive (2021–2026) |

Ban on most plastic cutlery, plates |

|

China |

Non-degradable plastics ban (2022–2025) |

National QSRs, takeout sector |

|

USA (selective) |

Local/state bans (CA, NY, WA, HI, etc., 2021–2025) |

Styrofoam, plastic bags, straws |

|

India |

Plastic ban (2022) |

All single-use plastics |

|

Australia |

State-wide bans (2021–2025) |

Expanded to coated paper |

2. Market Outlook and Size

- Global Biodegradable Food Packaging Market:

- 2024: $15.2 billion

- 2030 (projected): $30+ billion (CAGR 12–15%)

- 2024: $15.2 billion

- Key Growth Drivers:

- Regulatory mandates

- Corporate sustainability targets

- Consumer demand for low-waste, healthy living

- E-commerce and food delivery growth

- Regulatory mandates

3. Risk and Opportunity Matrix

|

Factor |

Opportunity |

Risk/Challenge |

|

Regulation |

Early mover advantage |

Compliance costs |

|

Consumer demand |

Brand loyalty, premium pricing |

Higher R&D/innovation costs |

|

Technology |

Patent, licensing, leadership |

Supply chain complexity |

|

Material supply |

Strategic sourcing |

Price volatility |

V. Innovation Case Studies: Success Stories & Lessons Learned

1. Fast-Food Pioneers

- McDonald’s China switched to bagasse trays and fiber cutlery in 2022, resulting in a 75% reduction in plastic waste in pilot cities within one year.

- Starbucks piloted cornstarch cold cups and PLA straws across major Asian markets, increasing customer engagement and positive sentiment scores by 30%.

- Jollibee Philippines deployed locally produced paper bowls with lids, enabling better delivery performance for soup-based menus and boosting market share among Gen Z customers.

2. Bioleader®: Empowering Brands Worldwide

Bioleader® supported a major global QSR in launching a new “green meal” menu by delivering:

- Custom-molded clamshells made from bagasse for burgers and fries

- Compostable cutlery kits (compostable cutlery supplier) with FSC-certified paper wrap

- Unique branding via laser engraving, increasing social media “unboxing” shares

- Supply chain flexibility to support seasonal promotions and rapid menu changes

Outcome:

The client reported a 60% year-over-year reduction in single-use plastic costs and a 24% increase in customer preference for “eco-packed” meals.

3. Customer Experience & Perception

According to a 2023 NielsenIQ survey:

- 69% of fast-food customers noticed packaging changes toward “eco” alternatives

- 58% stated that eco-friendly packaging influenced their choice of restaurant

- 44% were willing to pay 5–10% more for meals with compostable or biodegradable packaging

VI. Future Trends: Beyond Today’s Biodegradable Solutions

1. Smart & Functional Packaging

- Time-temperature indicators for cold chain and delivery accuracy

- QR-code traceability: Letting customers verify compostable claims and learn about material sourcing

- Biopolymer innovations: Next-gen films, nanocellulose, seaweed-based wraps

2. Edible & Reusable Packaging

- Early pilots of edible spoons and bowls in South Korea and India

- Reusable container programs with RFID tracking in the EU and US

3. The Next Three Years: Industry Predictions

|

Trend |

Likelihood |

Impact Level |

Timeline |

|

Home composting standards |

High |

Medium |

2024–2026 |

|

Biodegradable coatings |

High |

High |

2024–2025 |

|

Global EPR (Producer Responsibility) |

Medium |

High |

2025–2027 |

|

AI-driven supply chain |

Medium |

Medium |

2025–2027 |

|

Edible/functional packaging |

Low-Medium |

High |

2026–2030 |

Expert Perspective:

“Winning brands will be those who treat packaging not as an afterthought, but as a primary value proposition. It’s about delivering experience, trust, and transparency at scale.”

— Global Packaging Sustainability Council, 2024

VII. How Small Brands Can Overtake the Giants

1. Packaging as a Brand Differentiator

- Niche QSRs and food startups are using bespoke biodegradable packaging to build loyal communities, especially among eco-conscious millennials and Gen Z.

- Storytelling: Packaging includes QR codes leading to environmental impact calculators or “meet your manufacturer” videos.

2. Leveraging E-Commerce and Social Media

- Viral “unboxing” moments on TikTok and Instagram, driven by compostable, uniquely designed packaging

- Direct-to-consumer meal kits using certified compostable containers, often highlighting their compostable cutlery supplier partners

3. Practical Steps for Fast Growth

- Partner with certified biodegradable tableware manufacturers for flexible MOQs and design agility

- Invest in on-pack communication—“100% compostable, PFAS-free, made from renewable bagasse”

- Use customer feedback loops to continuously optimize product and packaging fit

Conclusion

Biodegradable packaging is fundamentally changing the rules of the fast-food game. The intersection of policy, innovation, and shifting consumer expectations is driving rapid transformation. Companies—large and small—must act now to secure sustainable supply chains, leverage new technologies, and build trust through radical transparency.

Brands like OXO Packaging® and Bioleader® demonstrate that with the right strategy, sustainability and profitability can go hand-in-hand. The global fast-food industry stands on the verge of its biggest packaging revolution yet—and those who act decisively will lead the race.

Biodegradable means a material can break down naturally by microorganisms, but the time and residue can vary. Compostable packaging not only biodegrades but also turns into non-toxic, soil-enriching material under specific composting conditions.

Yes. Most high-quality bagasse and CPLA containers are engineered for both hot and oily foods, maintaining shape and safety up to 120°C.

Absolutely. Leading standards include EN13432, ASTM D6400, and BPI certified compostable packaging, along with region-specific food-contact and compostability certifications.

Short-term, it may be slightly higher in cost, but bulk adoption, increased competition, and regulatory compliance are rapidly narrowing the gap. It often delivers value through branding, compliance, and customer preference.

It will break down faster than plastic, but optimal composting requires oxygen and the right conditions. Some items, like PLA, need industrial composting to fully degrade